Diversification across regions and asset classes is key since there is no asset class that consistently outperforms over time.

We manage your portfolios using models designed by BlackRock, one of the world’s largest asset management firm**. The purpose of these model portfolios is to deliver efficiency, transparency, and cost effectiveness. The selected UCITS ETFs that are part of the Model Portfolios are designed to meet specific goals such as global diversification, tactical exposures, and tax efficiency*. The implementation procedure guides each individual investor on how to invest in the most appropriate vehicle for their profile. The vehicle selection process is primarily driven by exposure, efficiency, and cost; leveraging more than 300 UCITS ETFs.

*Disclaimer: Please note that tax implications can vary based on individual circumstances and residency. While UCITS ETFs may offer tax benefits in certain cases, they are not universally applicable to all non-U.S. residents. We strongly advise consulting with a tax professional to understand the specific tax implications relevant to your personal situation.

**At our discretion, we may elect to deviate from any models provided by BlackRock.

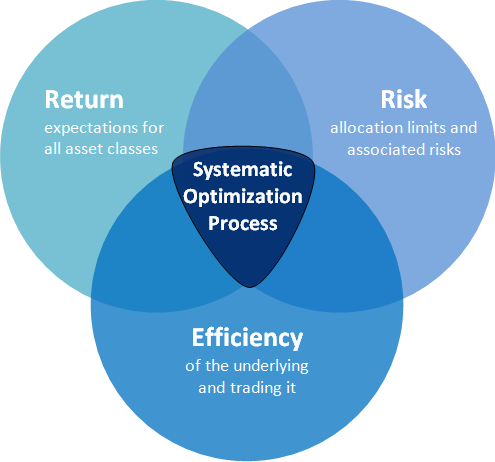

The variables in the systematic optimization process are Return-Risk-Efficiency.

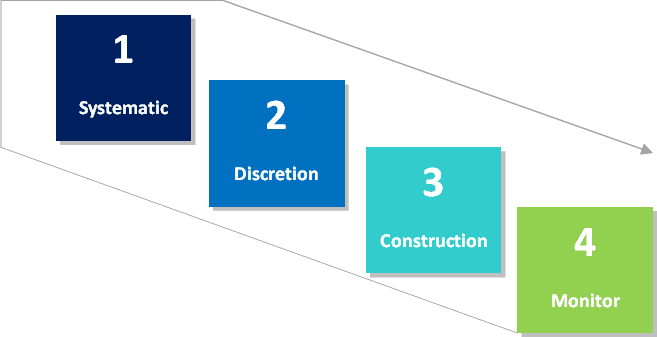

The Model Portfolio Solutions (MPS) Construction is a simple four-step process that leverages the entirety of BlackRock®’s technology and risk platform.

Risk Capacity

When you open your account, we ask you a few questions so we can determine your attitude towards risk and risk tolerance, investment knowledge and objectives, your net worth, time horizon and liquidity needs.

Investment Vehicles

In order to create globally diversified portfolios, the Model Portfolios use across-the-board uncorrelated asset-classes. In order to accomplish this, it only uses UCITS ETFs. Regularly, the universe of UCITS ETFs in the Model Portfolios is reviewed to identify the most appropriate ones to represent each of the asset classes. The Model Portfolios include the UCITS and ETFs that offer market liquidity, minimize tracking error and are tax efficient.

Asset Allocation

Through systematic investment processes and an in-depth analysis on each asset class, the use of models aims to maximize the risk-adjusted expected return. The objective is to create an asset allocation that produces the maximum possible return while respecting your particular risk tolerance. Translating investor outcomes and restrictions into globally well-diversified allocations: Return – Risk – Cost.

Monitoring and Rebalancing

To keep portfolios in track with long-term goals, the Model Portfolios are monitored and regularly rebalanced back to its target mix in an effort to optimize returns for their intended level of risk.

A UCITS ETFs is a security that usually tracks a basket of stocks, bonds, or assets like an index fund, but trades like a stock on a stock exchange. They closely track their benchmarks, such as Dow Jones Industrial Average or the S&P500. They provide great diversification, offer ample liquidity, and are tax efficient for investors who do not reside in the U.S.

We only use UCITS ETFs that have a definite mandate to passively track benchmark indexes. This restricts the fund manager to simply replicate the performance of the benchmark they follow and ensures the same level of investment diversification as the benchmark itself.